Page Not Found

Page not found. Your pixels are in another canvas.

A list of all the posts and pages found on the site. For you robots out there is an XML version available for digesting as well.

Page not found. Your pixels are in another canvas.

About me

Published:

Abstract: Hyperbolic geometry is a fascinating and non-intuitive type of non-Euclidean geometry. While Euclidean geometry describes flat surfaces like a sheet of paper, hyperbolic geometry describes surfaces with constant negative curvature, like the surface of a saddle or a Pringles chip. This negative curvature leads to a space that expands exponentially, having “more room” than flat space.

This property makes it a natural mathematical language for describing concepts in the AdS/CFT correspondence (which I will introduce at the end of the article), where a vast amount of information on a boundary of a set is encoded within a higher-dimensional “bulk” universe.

Published:

Abstract: This article details the architecture and methodology of an automated, quantitative trading system designed for cryptocurrency markets. The system’s core is a machine learning strategy that leverages unsupervised clustering to identify distinct market patterns and applies cluster-specific models to generate daily trade signals. Trade execution is managed through a sophisticated two-phase lifecycle, incorporating a momentum-based entry confirmation and dynamic in-trade risk management. The software is designed with a dual-mode operational framework, allowing for both live trading and robust, parallelized backtesting on historical data. This document outlines the system’s modular components, the intricacies of the trading and capital management strategies, and the implementation of its operational modes.

Published:

Abstract: This document details a proprietary algorithm designed to predict significant upward price movements, or “breakouts,” in crypto-assets. The methodology is built on a multi-stage process that transforms raw market data into a powerful selection heuristic. The algorithm leverages historical price action, market sentiment, and a novel, stability-focused machine learning approach to identify and leverage a more favorable, informed subset of the crypto-asset universe for potential trading opportunities.

Published:

Abstract: This paper details the “ClusterBuster” algorithm, a methodology for identifying potentially profitable market conditions using unsupervised machine learning. The approach leverages K-Means clustering to group historical financial data, with features primarily derived from rolling modes of the “Fear and Greed Index” over various lookback periods. Each resulting cluster is evaluated using custom performance metrics: the “breakthrough ratio” to quantify upside potential and the “loss ratio” to assess downside risk. The core of the algorithm is an optimization loop that systematically tests different numbers of clusters to identify a model that maximizes the proportion of high-performing, or “breakthrough,” clusters. The final output is an optimized clustering model that effectively isolates historical data patterns correlated with significant positive returns, providing a systematic approach to identifying trading opportunities.

Published:

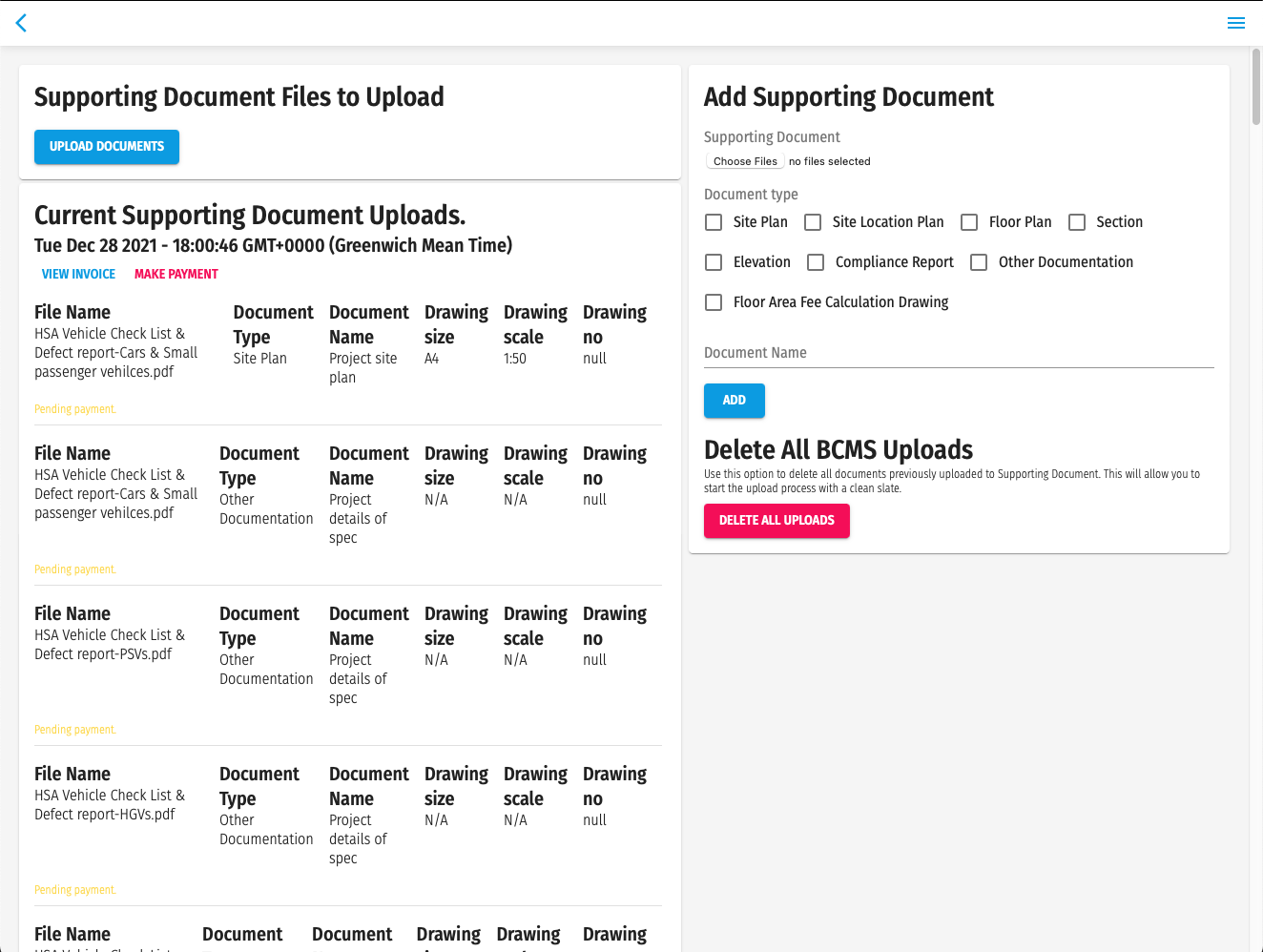

I provide public documentation of my work regarding BCMS Upload Services in this article where you can see how I structured the application and what decisions led me to those structures be implemented in the application. I show my own way of creating an application and apply my principles which are shown in my work in trin-app and trin-react.

Published:

Suppose toss_biased is a function which returns Heads (H) or Tails (T) with probability $p$ and $q$, \(p \neq q\), ie. the toss is biased.

Derive a function that simulates an unbiased coin toss

Group characters that are related through words in a given dictionary.

Build a Questionnaire with a progress bar for React Js app.

Get a detailed cost estimation from a range of home improvement projects. Click here to try it out.

Hassle free and faster file uploading to LocalGov BCMS website. Click here to try it out.